For all of you out there, your money generally grows at 0.05% per annum in a savings account (exceptions do apply). For the savvy consumers, many have turned to the Standard Chartered BonusSaver ("Bonus$aver") Account for a bonus rate of 1.88% p.a (up to S$25,000). However, this rate is only offered when you charge a mininum sum of $500 to your BonusSaver World MasterCard Credit or Debit Card.

To put things into perspective, a bank account with S$25,000 will earn an annual interest of $12.50 ($1.04 per month) with an ordinary savings account with most banks. Conversely, the same principal amount of money will earn $470 ($39.17 per month). As you can see, the difference in interest rate payments is substantially different!

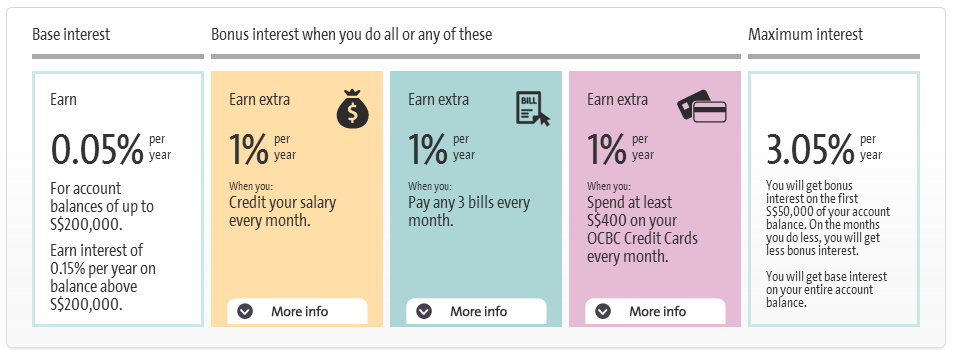

With the new OCBC 360 Account however, you will be able to earn a maximum of 3.05% p.a. (up to S$50,000). However, this bonus rate is not without its conditions. What really stands out for me is the progressive bonuses that one can enjoy from fulfilling a set of simple tasks.