OCBC 360 Account [Singapore] - 3.05% p.a.

Unlike most Singaporeans with a POSB/DBS account, I've grown up with an OCBC one. In fact, I do not even think I have a current POSB/DBS account. As a silent warrior of the banking industry, OCBC was never someone's first bank choice (unless of course like me, you enjoy a shorter ATM queue). However, all that is about to change with the new OCBC 360 Account.

For all of you out there, your money generally grows at 0.05% per annum in a savings account (exceptions do apply). For the savvy consumers, many have turned to the Standard Chartered BonusSaver ("Bonus$aver") Account for a bonus rate of 1.88% p.a (up to S$25,000). However, this rate is only offered when you charge a mininum sum of $500 to your BonusSaver World MasterCard Credit or Debit Card.

To put things into perspective, a bank account with S$25,000 will earn an annual interest of $12.50 ($1.04 per month) with an ordinary savings account with most banks. Conversely, the same principal amount of money will earn $470 ($39.17 per month). As you can see, the difference in interest rate payments is substantially different!

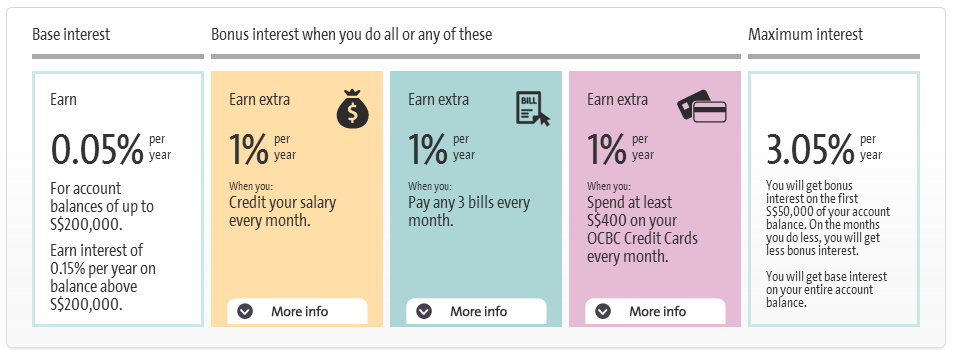

With the new OCBC 360 Account however, you will be able to earn a maximum of 3.05% p.a. (up to S$50,000). However, this bonus rate is not without its conditions. What really stands out for me is the progressive bonuses that one can enjoy from fulfilling a set of simple tasks.

To further simplify the above diagram, you will earn the following interest on the OCBC 360 Account.

- Do nothing and get 0.05% p.a.

- Credit your monthly salary (at least S$2,000 after CPF) and get extra 1.00% p.a.

- Pay 3 bills (e.g. Credit Card from other banks) and get extra 1.00% p.a.

- Spend S$400 each month on your OCBC Credit Cards and get extra 1.00% p.a.

Essentially, if you complete only Task 1 to 3, you will get 2.05% p.a. interest on that month. If you complete all four tasks (although the first one doesn't really count), you get 3.05% p.a. interest for that month. Pretty straightforward!

Personally, getting 2.05% p.a. is already sufficient for me to make the switch. I do not own any OCBC Credit Cards since I think they generally do not appeal to me (with the exception of the FRANK! Card) but having 2.05% p.a. interest without doing anything extra is excellent for me.

Using our previous example of having S$25,000, putting your money into the OCBC 360 Account can yield you an annual interest rate of $762.50 ($63.54 a month). If your principal sum is at S$50,000 it will yield you the following annual interest rates under the different deposit or saving accounts:

- Generic Savings Account (at 0.05% p.a.) - $25 (REALLY!)

- Standard Chartered BonusSaver Account (at 1.88% p.a. for first S$25,000 then 0.10% p.a.) - $495

- OCBC 360 Account (at a maximum of 3.05% p.a.) - $1,525

Do yourself a favour and make the switch. More details (including everyone's favourite terms and conditions) can be found via this link.