Analysing the OCBC 360 and Standard Chartered Bonus Saver Account (2017) - Which is Better?

I have been a strong advocate for OCBC Bank's 360 Account for the longest time and even with the recent changes that went into effect on 01 April 2017, it is still a great account to have - you now receive bonus interest on up to S$70,000 in the account. Almost every other major bank in Singapore has a competing product and I have previously concluded that the UOB One Account is not optimal since you only earn an effective rate of 2.43% instead of the 3.33% that they advertise. Standard Chartered Bank has a Bonus$aver (yes, it is unfortunately spelled that way) that apparently offers up to 3.88% p.a. of interest which sounds significantly more than what OCBC Bank advertises with the 360 Account.

Click HERE to find out more about the recent changes to the OCBC Bank's 360 Account!

Summary of OCBC Bank 360 Account

As a quick recap (click HERE for more information on the 360 Account), you now earn the bonus interest on up to S$70,000 (up from S$60,000) of your account balance and the highest interest interest rate you can earn is 3.05% p.a. if you ignore the bonus 1% (in purple) you get when your account balance is S$200,000 or more. If like me, you do not hold any wealth products or investments with OCBC Bank, you can earn up to 1.85% p.a. interest easily on the first S$70,000 in your 360 Account (S$1,295 per year). This is how I got to the 1.85% figure:

- Base Interest: 0.05%

- Salary Credit: 1.20%

- Bill Payment: 0.30%

- S$500 Credit Card Spend: 0.30%

- TOTAL: 1.85%

Summary of Standard Chartered Bonus Saver (Bonus$aver) Account

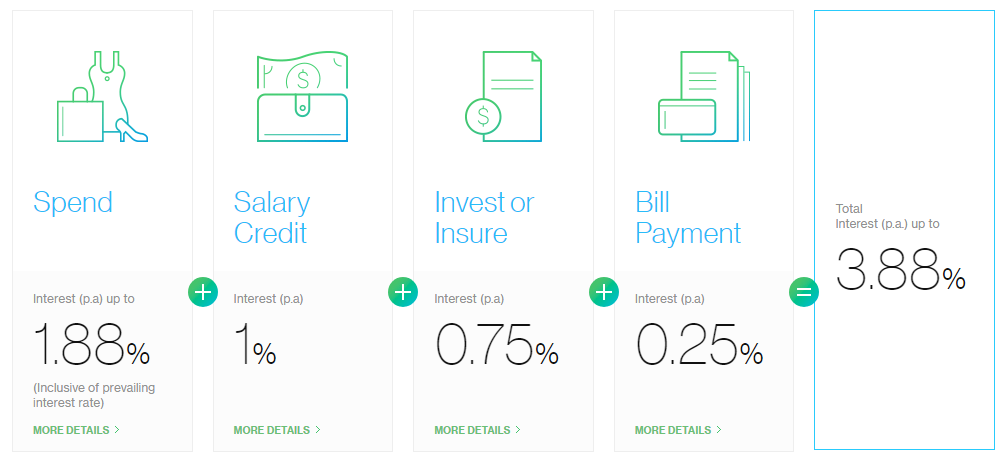

The Standard Chartered Bonus Saver (Bonus$aver) Account advertises a much higher interest rate of 3.88% p.a. and on first glance, it puts the OCBC Bank 360 Account to shame. Before we go into comparing the two accounts, let's first understand the general mechanics of it (I will definitely share a separate article on how you can actually achieve the 3.88%) - you can earn up to 3.88% on the first S$100,000 in your account. The biggest ones that stand out from the summary above has got to be the spend bonus (a whooping 1.88%!) but obviously there are caveats in achieving this so you do have to weigh it personally to evaluate whether this is the right account for you. Essentially, if you do not invest or insure with Standard Chartered, you can easily earn 2.13% on up to S$100,000 of your account balance (S$2,130 a year). This is how I got to 2.13% figure:

- Base Interest: 0.10%

- Salary Credit: 1.00%

- Bill Payment: 0.25%

- S$500 Credit Card Spend: 0.78%

- TOTAL: 2.13%

Comparing the OCBC 360 and the SC Bonus$aver Account

Now, let's get to the juicy bits - obviously there are different ways to compare the account and they will definitely differ depending on how much savings you have but for the sake of comparison, let's do two scenarios: Scenario One (S$70,000 Balance) and Scenario Two (S$100,000 Balance). Here are the advertised bonus interest rates for both accounts:

| Bonus Interest | OCBC | Standard Chartered |

|---|---|---|

| Salary Bonus | 1.20% | 1.00% |

| Payment Bonus | 0.30% | 0.25% |

| Spend Bonus | 0.30% | 1.78% |

| Insure and Invest Bonus | 1.20% | 0.75% |

| Base Interest | 0.05% | 0.10% |

| TOTAL | 3.05% | 3.88% |

Comparison of Maximum Bonus Interest Rate

The first thing you will probably notice is how the Spend Bonus on Standard Chartered's Bonus$aver Account is only 1.78% instead of 1.88% - this is not a typo error but it is simply because Standard Chartered has already factored in the base interest of 0.10% (which is higher than the 360 Account's 0.05%) in the spend bonus (naughty, naughty!). For the sake of fairer comparison, I have taken the 0.10% out and dumped it into the 'Base Interest' category. Assuming the two scenarios that I have mentioned earlier on, you will definitely earn more with the Standard Chartered's Bonus$aver Account:

Scenario One (S$70,000 Balance)

S$2,135 with OCBC Bank's 360 Account

S$2,716 with Standard Chartered's Bonus$aver Account

Scenario Two (S$100,000 Balance)

S$2,150 with OCBC Bank's 360 Account

S$3,880 with Standard Chartered's Bonus$aver Account

Photo Credit: OCBC Bank

Fantastic, Standard Chartered's Bonus$aver Account gives excellent interest compared to OCBC Bank's 360 Account but wait, let's make it a little more relevant to the average Singaporean now. There is a high chance that you do not hold any existing wealth or insurance products with OCBC Bank or Standard Chartered so let's remove that from the mix:

| Bonus Interest | OCBC | Standard Chartered |

|---|---|---|

| Salary Bonus | 1.20% | 1.00% |

| Payment Bonus | 0.30% | 0.25% |

| Spend Bonus | 0.30% | 1.78% |

| Base Interest | 0.05% | 0.10% |

| TOTAL | 1.85% | 3.13% |

Comparison of Bonus Interest Rates from Spending on Credit Card

So, Standard Chartered's Bonus$aver Account still looks great because the massive Spend Bonus is supporting the whole case. Let's dive deeper into this category - OCBC Bank's 360 Account requires S$500 worth of eligible spend each month on any credit card to trigger the 0.3% bonus. It sounds pretty miserable I know, but you are able to use pretty amazing cards like the OCBC Titanium Rewards Card (which gives up to 4 miles per dollar) and the OCBC VOYAGE Card (which gives up to 2.3 miles per dollar) - you can earn up to 24,000 miles per year by spending S$500 each month on the right credit card.

Photo Credit: Standard Chartered

The Standard Chartered's Bonus$aver Account gives you the opportunity to earn up to 1.78% bonus interest each year by doing the following:

- Spend S$500: 0.78% p.a.

- Spend S$2,000: 1.78% p.a.

Assuming that you spend only S$500 (for the sake of comparison) each month, you still benefit from the 0.78% p.a. interest which is far more superior to the 0.30% that the 360 Account has. The only caveat is that you will have to charge this amount to a Bonus$aver World MasterCard credit and/or debit card (which offers absolutely no additional points or cash backs!). Therefore, you are essentially trading 24,000 miles for 0.48% of interest - if you have S$70,000 and S$100,000 respectively, you could essentially benefit from S$336 and S$480 more each year by choosing interest over miles.

Depending on how much you value miles (most people use a conservative method of 2 cents per mile), the additional interest may or may not be attractive to you. My personal preference is to pick miles over money since 24,000 miles is more than sufficient for one-way to Bali on Singapore Airlines' Business Class (check out my review of the flight from SIN to DPS in Business Class HERE!). A one-way Business Class ticket from Singapore to Denpasar (Bali) on Singapore Airlines will cost S$1,144 but only 17,500 miles - you will also get to use the SIlverKris Lounge in Changi Airport prior to boarding. Therefore, it is possible to get amazing value that far exceeds the additional interest rate that you get from the Standard Chartered's Bonus$aver Account but once again, this depends on your personal preferences.

Comparing the Other Bonus Categories

If you were to compare the remaining categories (Salary, Bill Payment and Base), OCBC Bank's 360 Account comes up top - the 360 Account requires only a monthly salary of S$2,000 as compared to the Bonus$aver's S$3,000 and at the same time, it offers a higher 1.2% instead of SC's 1.0%. Sure, the base on the Bonus$aver is 0.05% higher but it is neutralised by the 360 Account's higher Bill Payment Bonus. All in all, OCBC Bank's 360 Account appears to be slightly better for the more conservative spenders.

Conclusion - Which Account is Better?

Depending on what your spending habits are and what your goal is, you may prefer one account over the other. My personal opinion is this - if you only care about maximising savings and cash backs, then the Bonus$aver is probably the way to go. At the end of the day, you do receive a lot cash back (in terms of interest) with the Standard Chartered's Bonus$aver Account. However, if you are a mile chaser like me, the OCBC Bank's 360 Account is the obvious choice - it allows you to earn a healthy cash back from interest (that you would not be able to earn miles from) and at the same time, benefit from a relatively decent mile accrual rate by satisfying one of the earn conditions. The deal-breaker with the Standard Chartered's Bonus$aver Account for me has got to be the high spend amount required on the Bonus$aver World MasterCard credit and/or debit card which offers virtually no benefits (except for triggering the bonus interest).

From 1 August 2025, the DBS Woman’s World Card will reduce its monthly bonus cap for 4 MPD on online spend from S$1,500 to S$1,000.