BOC Elite Miles World Mastercard offers up to 5 Miles per Dollar (No Cap, No Min) for Foreign Transactions - Should You Get It?

Anyone who has read The Straits Times today must have seen Bank of China's full-page ad for the brand new BOC Elite Miles World Mastercard that offers up to 5 miles and 2 miles per dollar for foreign and local currency transactions respectively. Now before you get exceedingly excited, do note that these earn rates are promotional and they will only last until 31 December 2018 (your card must also be approved by 15 December 2018). Following the promotional period, the regular earn rates for this card revert to 3 miles and 1.5 miles per dollar for eligible foreign and local currency transactions respectively.

Photo Credit: Bank of China (from The Straits Times)

5 Miles per Dollar on Foreign Spend (3 Miles after Promotional Period)

Getting 5 miles per dollar on all overseas spend (categorised by eligible transactions posted in non-SGD currencies) with no minimum requirement and no cap is spectacular - I tend to spend quite a bit overseas since most of my hotel stays are booked on flexible rates (therefore payment is often due on property instead of online) and I have been using the Standard Chartered Visa Infinite (SCVI) Credit Card to get 3 miles per dollar (no cap but S$2,000 minimum spend each month) on these expenses. With the BOC Elite Miles World Mastercard, I would be earning up to 66.7% more miles on foreign transactions until the end of the year. Once the promotional period ends, the BOC Elite Miles World Mastercard would be on par with the SCVI at 3 miles per dollar for all eligible foreign transactions.

| BOC Rewards Points per Dollar | ||

|---|---|---|

| Until 31 December 2018 | From 01 January 2019 | |

| Foreign Spend (Non-SGD) | 15 (5 Miles) |

9 (3 Miles) |

| Local Spend (SGD) | 6 (2 Miles) |

4.5 (1.5 Miles) |

2 Miles per Dollar on Local Spend (1.5 Miles after Promotional Period)

Offering 2.0 miles per dollar on all eligible local spend is probably unheard of - the PPC and Premier versions of the OCBC VOYAGE Card offers 1.6 miles per dollar (alongside the UOB Reserve, Citi Ultima and DBS Insignia) but these cards require either an extremely-high amount of annual income or plenty of AUM under each one of these eligible banks. While the UOB PRVI Cards (which I have personally cancelled) all offer 7 miles per S$5 (equivalent to 1.4 miles per dollar) on all eligible local spend, the BOC Elite Miles World Mastercard offers an incredible 2.0 miles (42.9% higher) per dollar during the promotional period. Once the promotional period ends on 31 December 2018, cardholders will be able to earn 1.5 miles per dollar on all eligible transactions made in SGD - still a great deal!

Photo Credit: Bank of China (from The Straits Times)

Cardholders of the new BOC Elite Miles World Mastercard will also be able to access Plaza Premium Lounges worldwide four times a year. Just as a comparison, the OCBC VOYAGE Card offers unlimited access (+1 guest) to Plaza Premium Lounges around the world - click HERE to check out all the credit cards in Singapore that will get you into an airport lounge for free! Now the BOC Elite Miles World Mastercard looks fantastic but before you jump right in to apply for it (there is no landing page at the time of writing and potential applicants are required to SMS in for application), here are a number of important facts that you should be aware of:

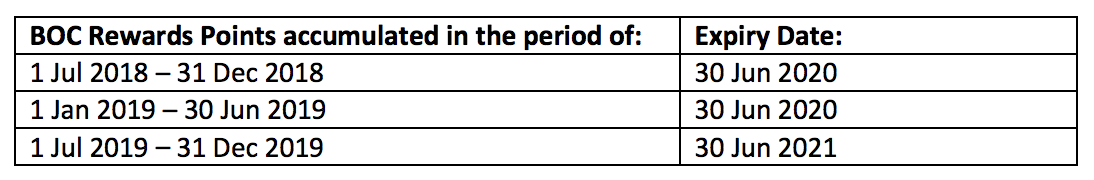

Expiry of BOC Rewards Points (12-18 Months Validity)

[Updated at 2:28PM: BOC has updated the expiry dates of BOC Rewards Points to become something a little more reasonable now.]

Photo Credit: Bank of China (from Terms and Conditions)

BOC Rewards Points will expire in 12-18 months from the time that you earn it - this is fairly reasonable (at least compared to the DBS WMC) but definitely something worth taking note of.

BOC Rewards Points can be converted into Asia Miles and KrisFlyer Miles

Similar to most credit cards in Singapore, the points accrued on the BOC Elite Miles World Mastercard can only be converted into Asia Miles or KrisFlyer Miles - conversion fee of S$32.10 (based on current GST of 7%) applies with each conversion. Conversion must be done in the following blocks:

- Asia Miles: Blocks of 6,000

- KrisFlyer Miles: Blocks of 10,000

Bonus BOC Rewards Points earned under Promotion will be awarded 2 Months after

According to the T&Cs on the bonus BOC Rewards Points (until the end of 31 December 2018), the bonus points will only be posted 2 months after from the date of transaction - this means that if you were to charge your credit card on 01 August 2018 (assuming you get it by then), you will potentially get it only in October 2018. Not a big issue but definitely something to keep in mind since the expiry date is fairly short.

Credit Card Application: SMS BOCCARD<space>EMST<space>NAME to 79777

SingSaver has just brought back the Team Cashback vs Air Miles campaign which will run from 8 May 2024 to 5 June 2024 - new applicants can enjoy fantastic sign-up gifts, as well as a chance to earn up to 34,000 bonus Max Miles or S$370 worth of voucher when your team wins. Additionally, all successful applications during the campaign period will also allow you to take part in the Grand Lucky Draw where a pair of Business Class tickets could be yours.