American Express Rewards Card

I have recently gotten 21,000 Membership Rewards points credited into my account from American Express for the Rewards Card. Previously, I mentioned that unlike in the US where Hilton Honors points are comparatively easy to earn, most cards in Singapore give you a really weak base earning rate for these HHonors points. Today, I am reiterating my point about the American Express Rewards Card and how easy it is to earn these bonus points (and more importantly, what you can do with them).

The AMEX Rewards Card is an entry-level American Express that most working adults will be able to qualify for. Unlike the Platinum or the Centurion Charge Cards, the Rewards Card requires only S$30,000 (or S$60,000 for foreigners) to apply. While it is true that AMEX is less widely accepted as compared to VISA/MasterCard, more and more merchants in Singapore are beginning to accept AMEX as a mode of payment.

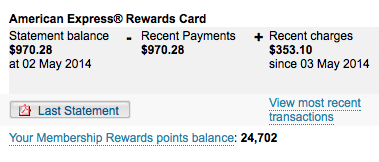

What makes this card so lucrative is the signing up bonus that comes with it. Upon spending S$1,500 within 3 months from the date of approval, you will receive 21,000 bonus Membership Rewards (MR) points. Coupled with the S$1,500 spend, you will have a minimum balance of 24,000 Membership Rewards points.

Being a Gold Hilton Honors member, I will most likely transfer this 24,000 Membership Rewards points to 30,000 HHonors points (1,000 MR points = 1,250 HH points). This is sufficient for 3 free nights at the DoubleTree by Hilton Hotel Kuala Lumpur or 6 + 1 nights free at the DoubleTree by Hilton Hotel Johor Bahru (amongst hundreds of other properties that you may choose to redeem your points on).

24,000 Membership Rewards points may be redeemed against:

1. Starwood Preferred Guest (SPG): 7,920 Starpoints

2. Singapore Airlines: Return trip to Bali on Saver (not inclusive of approximately S$150 tax)

3. S$110 Cash Credit: Approximately 7.3% Cash Rebate

4. River Safari (Adult Tickets): Six Tickets (to bring your friends and family)

For those of you who enjoy staying in SPG properties like Westin, W Hotel, Le Meridien, St Regis etc., do remember to check out this post to find out how you can earn yourself Gold status with just ONE qualifying stay (instead of the usual TEN) with a World MasterCard.

Even without the signing up bonus, the American Express Rewards Card is a pretty decent card on its own (for some aspects). The base earning for this card is 1 MR point per S$1 spend. There's a 100% bonus earning for the first three months from the date of approval which essentially gives you 2 MR points per S$1 spend. Additionally, you will also earn 50% bonus points at 5 locations (which you can nominate) - giving you 2.5 MR points per S$1 during the first three months.

Spending over S$5,000 in a year will earn you 50% bonus points on your base spending. For example, spending $1,000 each month for a period of twelve months will earn you the following:

Base Points: S$1,000 x 1 MR point x 12 Months = 12,000 MR points

First Three Months Bonus: S$1,000 x 1 MR point x 3 Months = 3,000 MR points

Welcome Bonus: 21,000 MR points

50% Bonus: S$1000 x 0.5 MR point x 12 Months = 6,000 MR points

TOTAL: 42,000 MR points

42,000 MR points will be approximately enough for TWO return tickets to Bali via Singapore Airlines and you just have to pay roughly S$150 in taxes each. If you charge more to your card, you may end up with a free stay at the Conrad Bali (see review here) through HHonors Points redemption.

What I love about American Express is the brand that is both functional and aspirational. While it is undeniable that a lower acceptance rate can be troublesome at times, the credit cards offered are usually of greater standards (this applies to AMEX cards issued by other banks too!). While the three months promotional window has not even closed for me, the bonus (21,000 MR) points have already been posted. Compared to other banks that take months to post promotional bonuses, AMEX is definitely one step ahead in terms of posting speed. Just do remember that you have to pay the Annual Fee (S$53.50) in order to qualify for this promotion.

Also, you may also choose to register for a current American Express promotion that rewards you with a S$10 voucher (up to S$30 per registered card) per S$50 spend at participating outlets - you may consider buying vouchers if you do not have any immediate spend. Do note that you can register multiple AMEX cards.