Win a Nintendo Switch and Get Up to S$300 Cash as a New Customer - SingSaver Mid-Year Deals (15-21 July 2020 Only!)

SingSaver Mid-Year Deals are back from 15-21 July 2020 and all customers (new and old!) who sign-up for any eligible products during the promotional period will stand a chance to win a Nintendo Switch (worth S$669) on top of the usual rewards that you can get (up to S$300 cash!). There are three categories of products that you can apply for under this campaign - Credit Card, Personal Loan, and Insurance - but do remember to do so before the end of 21 July 2020.

Click HERE to check out Singsaver Mid-Year Deals and win a Nintendo Switch!

Signing-up for any one of the listed products on the campaign page (as an existing or new customer) during the promotional period will give you one lucky draw chance - ten lucky winners will walk away with a brand new Nintendo Switch worth S$669! Every unique product will give you one lucky draw chance so signing-up for two unique products (e.g. a credit card and a personal loan) will double your chances. Apart from the lucky draw, new and existing customers will also get guaranteed sign-up bonuses of up to S$300 and S$200 cash respectively during the aforementioned period.

Credit Cards - Get up to S$300 (New Customer) or S$50 (Existing Customer) Cash

There are three different credit cards that you can sign-up for under the SingSaver Mid-Year Deals campaign and each card will give you one lucky draw chance to win a Nintendo Switch - signing-up for all three cards during the promotional period will give you three chances:

Citi Cash Back+ Mastercard® - Get 1.6% Cash Rebate on Everything!

The Citi Cash Back+ Mastercard® is one of the best cashback credit cards in Singapore as it allows you to earn 1.6% cash rebate on all eligible transactions that you charge to this card regardless of currency - there is no minimum spend required and no cap to the amount of cash rebates you can earn each month. This is a great option for those of you who are looking for a no-frills credit card since it will not require you to keep track of your spending each month. Eligible new customers will get S$300 cash reward (transferred into your bank account via PayNow) once the card has been activated and an eligible transaction (no minimum spend) has been made on the card. Existing Citi Singapore customers will receive S$30 cash reward via PayNow after charging the card for the first time.

Standard Chartered Unlimited Cashback Credit Card - Get 1.5% Cash Rebate on Everything!

The Standard Chartered Unlimited Cashback Credit Card offers a 1.5% cash rebate on all eligible expenses that you charge to the card. While it may be one of the best cashback credit cards in Singapore, the cashback is comparatively lower than the Citi Cash Back+ Mastercard® which offers a 1.6% cash rebate. While 0.1% more cash rebates may not really matter at the end of the day, you should still pick the card that gives you the most cashback for all your spending. With that being said, new-to-card Standard Chartered customers will get a pair of Jabra Elite Active 75t true wireless earbuds worth S$318) while existing Standard Chartered customers will get S$50 cash reward via PayNow upon card activation. New customers should also apply using SingPass MyInfo to get an extra S$20 cashback.

The American Express® Singapore Airlines KrisFlyer Credit Card - Get 1.1 KrisFlyer Miles per Dollar on Everything + up to 13,000 Bonus Miles for New Customers

For all you mile-chasers, The American Express® Singapore Airlines KrisFlyer Credit Card allows you to earn 3.1 KrisFlyer Miles per dollar on all eligible Grab transactions (capped at S$200 each month) and 1.1 KrisFlyer Miles per dollar on everything else. If you have not applied for any American Express and Singapore Airlines co-branded card before, you will be eligible for the welcome bonus of 5,000 KrisFlyer Miles after making your first transaction on the card. Additionally, all eligible new cardholders will also earn 8,000 bonus KrisFlyer Miles after spending S$5,000 within the first 3 months from the date of card approval. Applying for The American Express® Singapore Airlines KrisFlyer Credit Card during this campaign will also get you an additional S$100 cash reward which will be transferred to you via PayNow.

Apart from the three featured credit cards above, applying for any one of the listed credit cards below during the promotional period will also give you one lucky draw chance. Sign-up bonuses for new and existing customers will remain the same as above for respective banks:

Citi Rewards Card - 4 Miles per Dollar on Eligible Transactions!

Citi PremierMiles Card - General Spend Card for Mile-Chasers

Citi Cash Back Card - 8% Cashback on Dining, Groceries, and Petrol (S$25 Cap per Category each Month)

Citi Prestige Card (S$535 Annual Fee) - Great for Frequent and Luxury Travellers

Standard Chartered Rewards+ Credit Card - up to 2.9 miles per dollar but very low cap on maximum earn rate.

Standard Chartered Spree Credit Card - get up to 3% cashback (capped at S$60) each month for select spend categories.

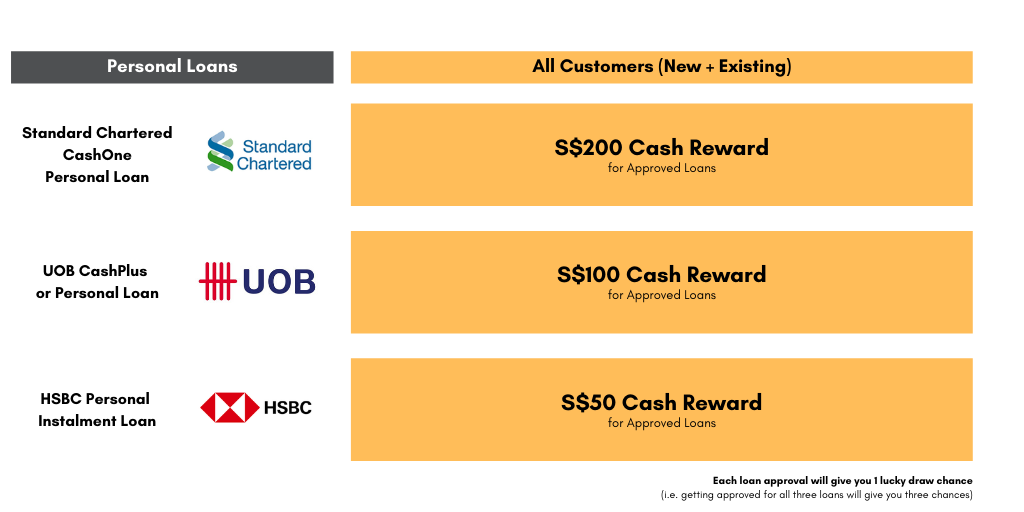

Personal Loans - Get up to S$200 Cash Bonus (All Customers)

Personal loans should only be utilised as a last resort or for justified emergencies but if you are in the market for one, you will be able to get up to S$200 cash reward (as well as a chance to win a Nintendo Switch) when you sign-up and get approved for one of the following loans during the SingSaver Mid-Year Deals.

There are three different personal loans that you can apply for under the SingSaver Mid-Year Deals campaign and depending on which one you apply for, you will be able to enjoy up to S$200 cash reward with your approved loan:

Standard Chartered CashOne Personal Loan - Effective Interest Rate from 6.95% p.a.

UOB CashPlus or Personal Loan - Effective Interest Rate from 7.72% p.a.

HSBC Personal Instalment Loan - Effective Interest Rate from 7.00% p.a.

Insurance - Up to 40% Off and Get S$20 Cash Reward!

I am personally a huge advocate for insurances and under the SingSaver Mid-Year Deals campaign, you will be able to enjoy up to 40% savings on eligible policies purchased during the promotional period. It goes without saying that each purchased policy will also give you a chance to win the Nintendo Switch and you will also get up to S$30 Cash Reward (transferred to you via PayNow) when you make a purchase.

There are three different insurance plans that you can purchase under this campaign:

While we are on the topic of insurance, I just wanted to point out the FWD Personal Accident and Infectious Disease Coverage again - while you will receive a lucky draw chance with the purchase of this personal accident policy, it is extremely crucial in my opinion to have a policy that protects you against unforeseen circumstances. I have written a rather extensive review of the FWD Personal Accident and Infectious Disease Coverage policy previously so do check it out if you are interested (especially if you do not have any idea what it does).

Looking to fast-track your way to Accor Gold status? Sign up for a new ALL Accor+ Explorer membership by 13 March 2026 and receive 2,000 bonus Reward points worth €40 (approx. S$60) to kickstart your 2026 travels.