This post aims to explain the reasons why average consumers go through OTAs, while seasoned travellers largely prefer to make their reservations with the hotel directly.

Why book with OTAs?

One of the major reasons why travellers book hotel stays through an Online Travel Agency (OTA) like Agoda over the official hotel website is due to perceived cost savings. It is also not uncommon for these OTAs to pay out some sort of benefit (e.g. points or rebates) in order to encourage loyalty. As the competition between agencies intensify, consumers are faced with price differences as well as confusing terms and conditions in relation to cancellation terms. Websites like Trivago do a pretty good job at aggregating prices across distribution channels to make price comparisons simpler. Such websites are also prevalent across flights and consumer products.

OTAs are great if you're looking for a place to rest your head while travelling. Especially so if you have a fixed budget and have relatively no preference over the brand of accommodation provider. For example, someone who has never visited Kuala Lumpur (Malaysia) may choose to stay near the Petronas Twin Tower due to its iconic value and centralised location. As such, one may choose to search for accommodation options based solely on location and price constraints. Photographs on the booking website as well as TripAdvisor provide a wealth of information for these travellers.

Why book with hotels directly?

With the aforementioned benefits associated with booking through OTAs, why then would people choose to potentially pay a higher price (in absolute terms)? Reservations that are made directly with the hotel (without the use of a travel intermediary) are largely eligible nights and stays that count towards earning a preferred status. For example, completing ten stays that are booked through Expedia with a participating property of the Starwood Preferred Group (SPG) will not grant you any status at all. Conversely, should these stays be booked directly with the participating property, you would have earned yourself a shiny Gold status that gives you significant benefits for at least a year (refer to this post for SPG Gold benefits and how you can get it in ONE stay).

Additionally, most reputable hotel chains offer a Best Rate Guarantee (BRG) meaning they will match the price of the same room (with similar cancellation terms) found on other third-party websites. In fact, the Intercontinental Hotel Group offers the first night free should you find a better rate elsewhere.

That being said, the process of getting approved for a BRG can be tedious and frustrating since hotels usually give a better cancellation policy when booking directly through them, therefore rendering a lower rate found elsewhere useless for this purpose. You should always peruse the terms and conditions of individual hotel chain's BRG (or equivalent) carefully before submitting a claim form in order to minimise any potential discontentment. More importantly, the BRGs are there as an assurance for travellers and therefore should not be taken advantage of - bearing in mind that a violation of T&Cs may lead to the termination of your loyalty program membership.

Which distribution channel should I choose?

There's no hard and fast rule in choosing which distribution channel for accommodation booking. This is similar to picking which credit card to use for optimal benefits. For consumers who prefer to go through OTAs for a seemingly cheaper rate, there are many other ways to augment the benefits. For example, Hotels.com awards one free night with every ten nights purchased (of course, terms and conditions apply to such statements). Consider a scenario where you book 10 nights for a Deluxe room at a particular property, you will gain 1 night at a Deluxe room free. This is equivalent to an approximate 9.1% discount. Alternatively, HotelClub gives you up to 7% cashback (in HotelClub reward dollars) when you book directly with them.

There are also 5% to 10% discount codes that float around the internet that travellers are able to utilise to drive room prices down even further. Websites like TopCashback allows you to earn up to 15% of your hotel bookings back. However, these websites may be tricky to use for first-timers as it will require you to click through to the OTA via these Cashback Saving websites. Also, using a promotional code that isn't listed on TopCashback for example, will render the 15% cashback ineffective. Whilst there are many other similar websites such as eBates, you need to find one that offers you the highest cashback for the OTAs or websites you use. I personally like these two as you will be able to transfer the balance into a verified PayPal account. Some of these sites only pay out cheques which may be tricky for all of us living outside the US. I've used both websites in Singapore and I've not faced any trouble with them at all. I personally prefer TopCashback as it allows you to transfer your existing balance out at any time.

Assuming a $100 a night room for 10 nights with HotelClub, the internal Membership Rewards will give you up to 7% back - effectively $70 for $1000 spend. With TopCashback, you should get back approximately $150. However, these cost savings do not stop here. If you combine this with the right credit card, you can get even more bang for less of your buck.

The ANZ Travel Visa Signature Card in Singapore gives 2.8 Travel$ per S$1 spend on certain websites. Conveniently, HotelClub and Hotels.com are on that list amongst other websites. Therefore, S$1000 spend will give you 2,800 Travel$. You may choose to redeem 2,750 Travel$ for $50 cash credit. Awarding 2.8 Travel$ per SGD gives you an effective cashback rate of 5.1% on top of the savings you're already getting from the OTA and TopCashback method. Getting $200 (and 50 Travel$) back for $1,000 spend on accommodation gives you an approximate 20% discount off travel spending.

With all those benefits, why should I book directly with hotels then?

Going back to my previous point about status benefits, booking directly with hotels can also gain you certain advantages/benefits. Since hotels do not need to pay high intermediary fees when you book directly through them, they are able to offer other perks. For example with Hilton Hotels & Resorts, there are various offers that you can always take advantage of. Right now, there's a 25% off weekend stays in Asia Pacific promotion going on. Hilton HHonors members will earn points for eligible spend in participating hotels and resorts. As a Hilton HHonors Gold member, spending S$1,000 (approximately US$800) will earn me 14,000 HHonors Points (10 base points, 5 bonus points for MyWay benefit and 2.5 bonus gold status points per eligible US dollar spent).

Being a HHonors Gold member also means that I get a complimentary room upgrade (subjected to availability), late check-out and free breakfast amongst other benefits. Additionally, when using my points to redeem for free nights, I get every fifth night free. That is a 20% cashback (or rather, points-back) in its own way. Coupled with the right promotion and credit card for hotel expenses, one can easily rack up bonus points in participating hotel loyal programs.

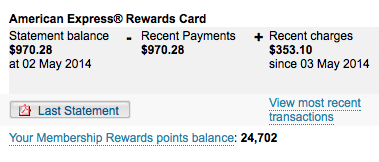

For hotel promotions, please refer to my previous entry on Conrad Bali where I racked up 25,750 HHonors Points from staying just two nights (excluding credit card points and eligible spend). For credit card promotions to earn HHonors Points in Singapore, please refer to this post to see how you can earn up to 19.31 HHonors Points per S$1 spend on the American Express Rewards Card. Combined with base earnings from Hilton Hotels & Resorts, spending S$1,000 can net me at least 33,310 (14,000 + 19,310) HHonors Points (before other promotions) which is sufficient for 7 (six and one free) nights at the new DoubleTree by Hilton Johor Bahru property at 5,000 HHonors Points a night.

To summarise both options, booking through an OTA can get you back approximately $200 for $1,000 spend while booking directly with a hotel like Hilton will earn you eligible nights that will get you a desired status at hotel chain. It can also get you seven free nights at a low redemption rate property on top of other status benefits you may receive. I personally like to book directly with hotels to earn eligible nights that count towards the retention of loyalty status (with some exceptions). However, if I decide to stay in some place that does not participate in any loyalty programs of my choice, I will most definitely choose the method that saves me the most money.

At the end of the day, you'll need to pick a method that best suits your spending habits and personal preferences. Leave a comment below if you need any tips that you think I may be able to offer regarding your next hotel reservation and I'll be sure to help you.