Analysing the OCBC 360 and the UOB One Account - Which One for You?

There are many differences between the OCBC 360 and UOB One Account but one thing they have is common is apparent - (much) higher interest rates on your savings. Personally, I use the OCBC 360 account but this does not mean it is better. It is simply more suitable for me based on my spending habits. The first question though, is why bother with one of these accounts? Why not just put your money into a regular savings account? The answer is simple - you earn at least 65X more interest (calculated using OCBC 360 account). To put that in numbers, you earn S$1,950 instead of S$30 interest each year!

Bonus Interest with OCBC 360 | Photo Credit: OCBC

OCBC 360 (Get up to 3.25% Interest on up to S$60,000)

If you earn at least S$2,000 a month and it is credited into your bank account through GIRO, you should definitely consider the OCBC 360 account since you can earn up to 3.25% (3.20% bonus + 0.05% base) Interest on the first S$60,000 of your account balance. Any amount that exceeds this S$60,000 threshold will earn a base interest of 0.05% per year. Also, you will get 1% per year on any incremental balance from the previous month's average daily balance.

I personally do not use any OCBC Credit Cards since they don't appeal to me at all - I'm a Miles guy and let's just say OCBC doesn't have the best Miles cards. I also do not insure or invest with OCBC and therefore I will not be earning that bonus interest rate. With all that being said, only the following categories are applicable to me:

- Base Interest: 0.05%

- Salary Bonus: 1.20%

- Bills Bonus: 0.50%

- TOTAL: 1.75%

Still, 1.75% is still a huge jump from the regular 0.05% (35X more!) and if you look at the maximum sum that will enjoy this bonus (S$60,000), you can essentially earn S$1,050 instead of a pathetic S$30 each year (not withstanding any bonus interest paid on interest accrued each month and incremental balances).

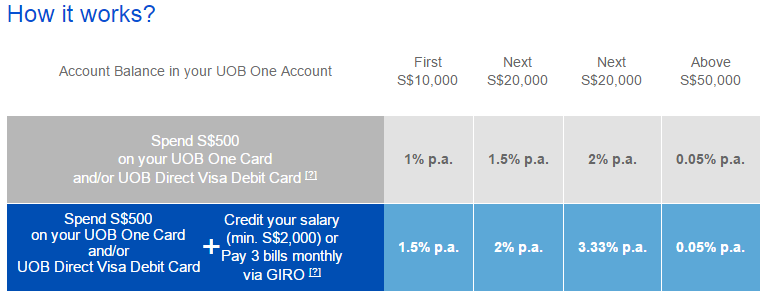

UOB One Account | Photo Credit: UOB Singapore

UOB One Account (Get up to "3.33% Interest" for balances up to S$50,000)

UOB advertises a 3.33% interest rate but this is not exactly accurate. In reality, you will only earn approximately 2.43% interest p.a. with a S$50,000 account balance (with is the threshold amount). While the criteria for enjoying the maximum bonus rate is significantly more relaxed when compared to OCBC 360, you only earn 3.33% interest on S$20,000 out of S$50,000 of your balance. The maximum interest you can earn on the threshold amount (S$50,000) is as follows:

| UOB One Account Summary | ||

|---|---|---|

| Account Balance | Bonus Interest Rate | Annual Interest (S$) |

| First S$10,000 | 1.50% | S$150 |

| Next S$20,000 | 2.00% | S$400 |

| Next S$20,000 | 3.33% | S$666 |

| Grand Total | S$1,216 | |

The Interest (S$1,216) shown above is how much you will earn on your UOB One Account assuming you have S$50,000 in your account and satisfy the following two criteria. Also do note that this brings about an approximate annual interest rate of just 2.43% p.a.:

- Credit Salary (minimum S$2,000 per month)

- Spend at least S$500 a month on UOB One Card and/or UOB Direct Visa Debit Card

The calculation above excludes any bonus interest paid on interest accrued each month. Honestly, if you are even considering this option, the only card you should rely on is the UOB One Card. If you factor in how much rebates you earn from the UOB One Card by spending say S$500 a month (S$6,000 a year) - you can bring the total gain from S$1,216 to S$1,416 (since you earn S$200 with the UOB One Card) - this brings the effective annual rate of interest to 2.83% p.a. (still under the 3.33% p.a. that people are generally used to seeing).

Comparing the OCBC 360 and UOB One Account - Which is Better?

As I have mentioned earlier, there really isn't a clear winner between these two accounts. At the end of the day, it all boils down to what your spending habits are and what you would like to maximise. If I had to provide a recommendation however, here it is! If you love cash backs and are already a UOB One Card user, you should definitely go with the UOB One Account! However, if like me, you enjoy earning miles (and truly some of the best mile-accrual cards are on UOB), then you should opt for the OCBC 360 Account and take advantage of the slightly lesser interest rate.

To make them a little more comparable, let's assume that we only have S$50,000 in our accounts for the sake of comparison.

| Comparison of OCBC 360 and UOB One Accounts (Assumption: S$50,000 Account Balance) |

||

|---|---|---|

| Key Highlights | OCBC 360 | UOB One Account |

| Maximum Interest Rate | 3.25% | 2.83% |

| Maximum Interest (S$) | S$1,625 | S$1,416 (includes S$200 cashback) |

| Scenarios | ||

| Scenario 1 Salary + Pay 3 Bills ONLY |

S$875 | S$25 |

| Scenario 2 Salary + Spend S$500 a Month ONLY |

S$875 | S$1,416 (includes S$200 cashback) |

The calculation above excludes any bonus interest paid on interest accrued each month. I personally associate myself to "Scenario 1" since I think that S$500 a month spend can be better channeled to a different credit card - S$6,000 spend could potentially be worth 24,000 miles and I'd value that over incremental interest any day! However, if you are more of a "Scenario 2" person, then you can definitely see how the UOB One Account has an advantage over the OCBC 360.

![[FAKE] World of Hyatt Rumours: Category 9 and 10 Incoming, New Premium Credit Card, and Award Top-offs](https://images.squarespace-cdn.com/content/v1/52ccee75e4b00bc0dba03f46/1591666118538-OES55QII65TO7DNJTN9G/image-asset.jpeg)

The end of an era for one of Singapore’s most accessible airport limo perks: UOB will officially discontinue the complimentary airport transfer benefit for the UOB PRVI Miles American Express Card from 1 April 2026.