Profit maximising businesses are often interested in one thing. They are often concerned with the optimum level at which the business operates. In many instances, they want to know what is the best price to sell a product or service in order to maximise revenue. As such, they sometimes hire consultancy firms to help them with pricing and strategy (amongst many other things), hoping that it will help them drive profit. In economics, this is known as the efficient frontier. In day-to-day life, I call this is a simple cost benefit analysis. More simply put, what are you willing to pay for an extra unit of enjoyment.

I recently made a reservation for a weekend at the Conrad Bali. The initial motivation was simple - I needed a vacation and the Conrad Bali seemed like a property that I will enjoy. As a Hilton Gold member, I earn 25% bonus on my base points earning (US$1 = 10 Points). Additionally, since I selected Points and Points as my preferred method for point accumulation, I also get a 50% bonus on base points, resulting in a total of 75% bonus on base earnings when combined with the Gold benefit.

I looked around the Conrad Bali website and realised that they were having a special 10th Year Anniversary promotion rate which comes with a range of benefits. This rate is valid for bookings made by 31 March 2014 for stays through 31 December 2014. More details can be found via the website.

The promotion included daily buffet breakfast for two, return airport transfer (US$22 each way usually), 60-minutes body massage for two at the Jiwa Spa, 15% discount on F&B and as a Gold HHonors member, I also received a complimentary upgrade to the next room category as well as 10,000 bonus points.

Since I wanted the Deluxe Ocean King room, I booked the Deluxe Resort King room (one tier below the room I wanted) for the complimentary upgrade. Whilst most Hilton properties do provide a one-tier minimum level of upgrade for Gold HHonors members, this upgrade was always subjected to availability. Since I really wanted the Deluxe Ocean King room, I decided to go for the aforementioned anniversary promotion as the upgrade is guaranteed in this rate. As a rule of thumb, it is also worth calculating what the upcharge of the next room type is, in order to find the optimum room category that you should book given your willingness and capability to pay. To illustrate my point, consider the following example:

The room rates for the Conrad Bali are as follow (excluding tax and service tax):

1. Deluxe Garden King (US$185)

2. Deluxe Resort King (US$205)

3. Deluxe Ocean King (US$245)

If I were to select Option 1 and got upgraded to Option 2, I would effectively benefit from a US$20 upgrade (in terms of monetary value). However, if I were to select Option 2 and got upgraded to Option 3, I would have gotten a US$40 upgrade instead. Of course having said that, calculations like that should only serve as a guide in your decision making process. It is fair to assume that the rooms get better with higher prices (although this may not be the case for all properties) and thus, sometimes spending a little more can get you a lot more benefits.

In conjunction with the Conrad Bali promotion for 10,000 bonus points, there are also two concurrent promotions that are valid with this stay. As the first Conrad/Waldorf Astoria property that I am staying this year, I will gain 2,000 bonus points. Additionally, I also gain 2,000 bonus points for each night in a Conrad/Waldorf Astoria property. Since I am staying for two nights, I will be getting 4,000 bonus points from this targeted promotion. Every US$ spent on the property will also give me a net 17.5 points (10 points from normal earnings, 5 points from the selected point accumulation method and 2.5 points as a Gold HHonors member bonus). Since the total stay is approximately US$500, I will gain roughly 8,750 points from the stay. Additionally, since breakfast is included in my rate, I have opted for the 1,000 bonus points as a My Way bonus for Hilton Gold members. In total, this stay will earn me the following number of points:

Base: 5,000

50% Bonus: 2,500

Gold VIP 25%: 1,250

My Way Bonus: 1,000

Brand 1st Stay Bonus: 2,000

2k Points Offer: 4,000 (two nights)

Anniversary: 10,000

TOTAL: 25,750 Points

Valued at $0.005 per point, these points are worth approximately US$129. To put things into perspective, some properties in countries that I am intending to go have a reward night at only 10,000 points. This means that I have effectively earned myself 2 free stays at a hotel of my choice. It is however important to note that the number of points required for each property may vary greatly. For example, the Conrad Koh Samui (Category 7) requires 95,000 points a night whilst some Category 1 hotels require only 5,000 points for a free night.

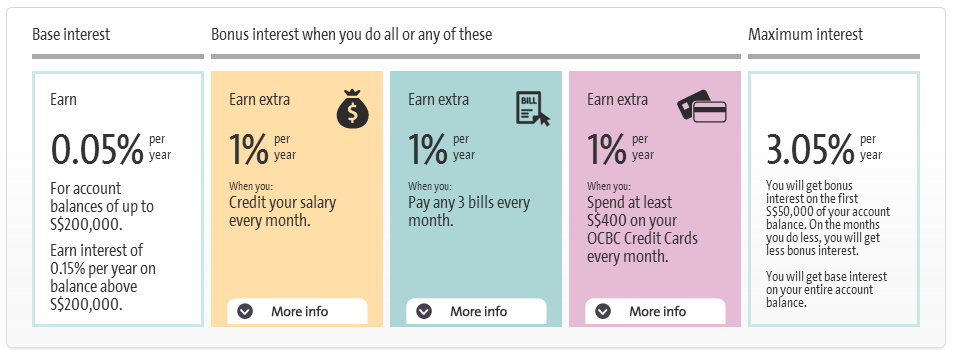

In Singapore where we do not have any branded hotel credit card, it is extremely difficult to earn points/status across most hotel chains. With regards to earning Hilton HHonors points with credit card spend, Citibank gives you 2 Hilton HHonors points for 5 Citi$. Since non-promotional spending gains you only 1 Citi$ per SGD 1 spend, you are effectively getting only 0.4 Hilton HHonors points per SGD 1. The credit cards in Singapore pale in comparison when comparing to the Hilton HHonors Surpass Card (AMEX) in the US that earns you 12 base points with each dollar spent on Hilton property.

I charged my Conrad Bali bill to my UOB PRVI Miles Platinum (AMEX) card instead. Although I can not redeem my UNI$ for Hilton HHonors points, I have gotten 812 UNI$ since I was billed in a foreign currency (6.25x multiplier), which is equivalent to approximately 1,600 miles. Additionally, because this transaction was travel related and more than SGD 500, I will be given a free limousine ride (either Mercedes or Chrysler) to the Airport for my Bali trip.

Is this the optimal solution to booking my trip? The answer is no. Everyone of us places different levels of importance on different things. While some of us may value points over cash backs, there are many people out there who are interested in reducing the total amount of expenditure. It is therefore important for you to know what matters to you first, and then find the optimal way of doing things.