More Changes Are Coming to OCBC 360 Account From 01 October 2020 - Effective Interest Rate to Increase on Paper but Would Probably Decrease for Most Account Holders

OCBC Bank made significant reductions to the bonus interest rates on the OCBC 360 Account on 01 July 2020 which took the effective interest rate (EIR) down from 3.35% p.a. to 2.15% p.a. From 01 October 2020, the bank will introduce further changes to the savings account that will bring up the EIR on paper but in reality, I would expect most account holders to take a hit on savings (especially if you do not insure and invest with the bank).

Photo Credit: OCBC Bank

Bonus Interest Will Apply to First S$75,000 (up from S$70,000)

The bonus interest rates on the OCBC 360 Account current applies to the first S$70,000 of account balance only - starting from 01 October 2020, this will be increased to S$75,000 with a few notable caveats. The account currently offers a two-tier interest bonus on savings but it will introduce a three-tier interest bonus next month. While the increase from S$70,000 to S$75,000 sounds great, your EIR will actually drop if you maintain status quo with your OCBC 360 Account at S$70,000.

Photo Credit: OCBC Bank

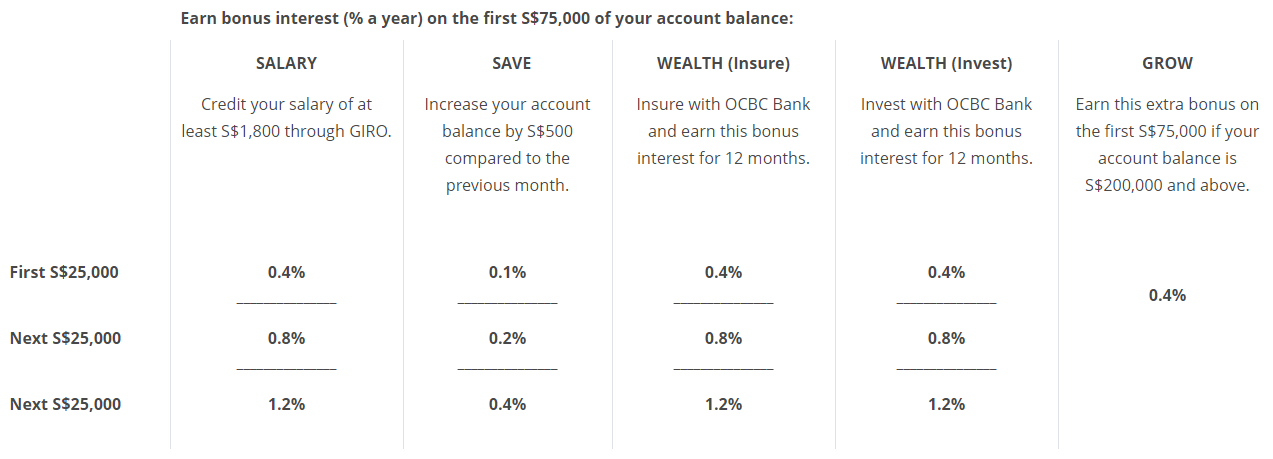

Introduction of Three-tier Bonus Interest Rates

The OCBC 360 Account currently awards bonus interest on the first S$70,000 in two-tiers - the first S$35,000 earns a lower bonus interest while the second S$35,000 earns a higher bonus interest rate. Starting from 01 October 2020, there will be three-tiers of S$25,000 each and the bonus interest rates will vary across all three levels. While the EIR for the main bonus categories did not change, changing a two-tier bonus to a three-tier bonus is actually a slightly devaluation as you will earn less bonus interst if you maintain status quo.

Decrease in GROW Bonus (EIR from 0.80% p.a. to 0.40% p.a.)

It is important to note that I do not consider the Grow Bonus in my calculation of EIR as I do believe that most people keep that much money in a low-yield savings account - personally, I have never benefited from this bonus as I put excess cash towards investments. The OCBC 360 Account has a Grow Bonus which currently offers 0.80% p.a. bonus on the first S$70,000 if your account balance is S$200,000 and above., Starting from 01 October 2020, the Grow Bonus will be reduced from 0.80% p.a. to 0.40% p.a. but I do not suppose most account holders will be affected by this change.

Increase in WEALTH Bonus (EIR from 1.20% p.a. to 2.40% p.a.)

If you insure and invest with OCBC Bank, then this is definitely a positive change. Currently, the OCBC 360 Account offers up to 1.20% p.a. bonus interest on the first S$70,000 if you insure and/or invest with the bank but starting from next month, you will earn up to 1.20% p.a. bonus interest on each category - insuring AND investing will allow you to earn up to 2.40% p.a. on the first S$75,000. By introducing an additional 1.20% p.a. interest on the Wealth Bonus, the EIR for the OCBC 360 Account goes up but as I have mentioned earlier, I do not belive most account holders are actually utilising this benefit right now.

Photo Credit: OCBC Bank

Reduction in EIR from 1.25% p.a. to 1.08% p.a. for Account Holders Who Only Credits SALARY and SAVEs

You might be surprised to know this but the OCBC 360 Account no longer rewards you for spending on OCBC Credit Cards - the Spend category has been removed back in July 2020 so unless you are investing and insuring with the bank, you are likely to be earning only bonus interest rates on the Salary and Save categories.

Essentially if you are only earning bonus interest rates on the Salary and Save categories (I would imagine most account holders fall into this group), the EIR will decrease from the current 1.25% p.a. to 1.08% p.a. starting from 01 October 2020 (assuming you have a new account balance of S$75,000 then). If you maintain the status quo with your account at S$70,000 (but still manage to hit the Save bonus), your EIR will fall further to 1.04% p.a. starting next month.

Conclusion

On paper, you can earn a maximum EIR of 2.68% p.a. interest (excludes Grow Bonus) on the OCBC 360 Account from 01 October 2020 but that is only if you do insure AND invest in eligible OCBC products. If you do not this, the EIR on the OCBC 360 Account is actually a lot lower than you would expect - you should check out the interest calculator on the website once it is updated to get a rough estimation. Personally, I have moved a lot of my funds out of OCBC and started investing them in Syfe and Stashaway where I have seen positive gains from my investments - I will be sharing more about these products in the near future.

Effective 1 December 2025, UOB will lower the interest rates on the UOB One Account for the third time this year. The maximum Effective Interest Rate (EIR) will drop from 2.50% p.a. to 1.90% p.a. for account holders with a balance of S$150,000 who credit their salary and meet the minimum card spend. This revision represents a reduction of S$900 in annual interest for those maximising the account.