OCBC 360 Account to Significantly Reduce Bonus Interest Rates from 01 July 2020 - Everything You Need to Know

OCBC Bank has introduced some changes to the OCBC 360 Account last month that took the Effective Annual Rate (EAR) down to 3.35% p.a.. Today, OCBC has published a notice on further bonus interest rate reductions to the OCBC 360 Account that will go live on 01 July 2020. There were slight changes to the OCBC 360 Account that went live on 02 May 2020 and that took the EAR down from 3.45% p.a. to 3.35% p.a. - this represented a S$70 loss in bonus interest rate in a year (assuming a S$70,000 account balance). With the upcoming changes on 01 July 2020, the EAR of the OCBC 360 Account will be further reduced to 2.15% p.a..

What is Happening on 01 July 2020?

In summary, the EAR that you will earn on your OCBC 360 Account will go from 3.35% p.a. to 2.15% p.a.. Assuming a S$70,000 account balance, the total interest (base and bonus) that you earn on this account will go from S$2,345 to S$1,505 (almost 36% lesser!). With these upcoming changes, it might be a good idea to rethink your strategy and possibly reallocate your funds for greater returns (even though other banks might start reducing the bonus interest rates too).

Decrease in Salary Bonus (EAR from 1.80% p.a. to 0.90% p.a.)

The most significant upcoming change to the OCBC 360 Account will have to be the reduction in bonus interest rates for crediting a salary of at least S$1,800 each month - this will go down from 1.80% p.a. to a mere 0.90% p.a.. This change alone represents a S$630 decrease to the total bonus interest that you earn on the account each year.

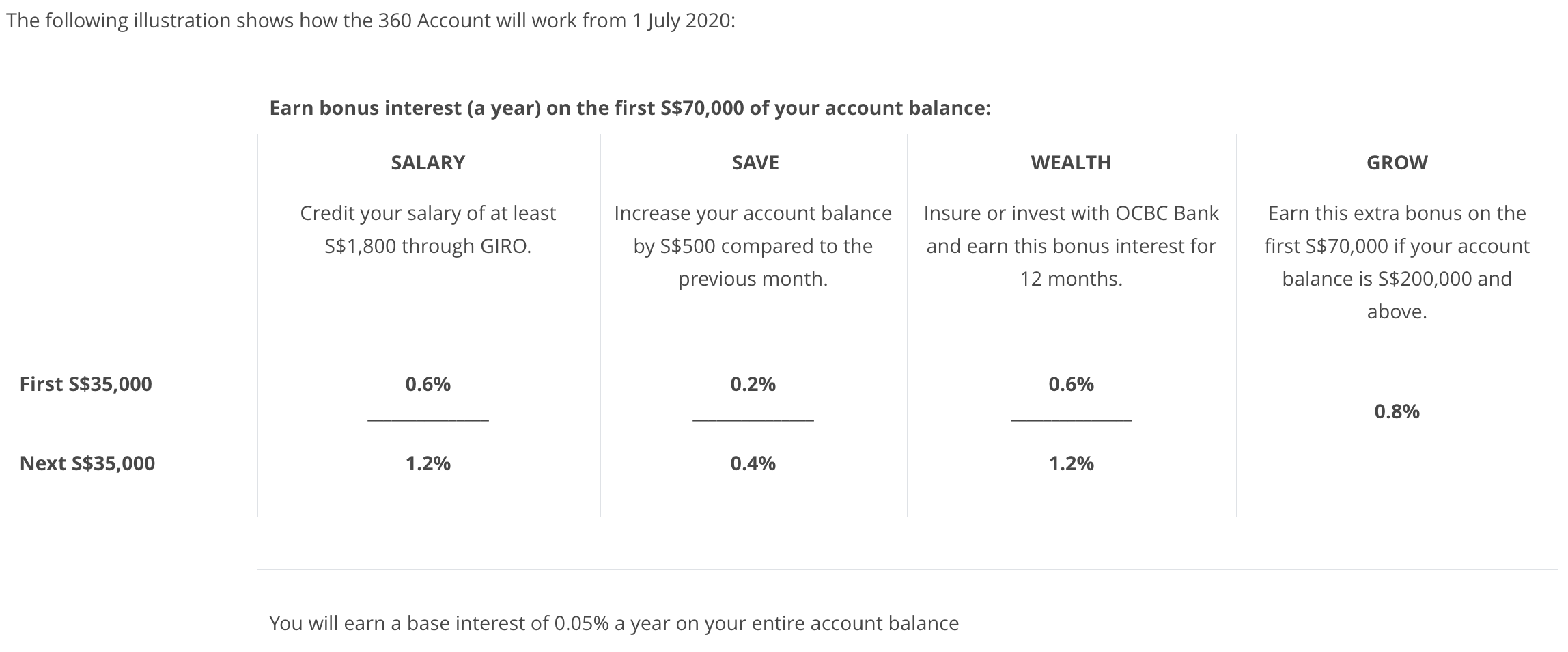

As you may already know, the OCBC 360 Account offers two tiers of bonus interest - a lower bonus interest rate applies to the first S$35,000 and a higher one applies to the next S$35,000. Back on 02 May 2020, OCBC Bank has actually increased the bonus interest rates for this category on the second S$35,000 from 2.00% p.a. to 2.40% p.a. but from 01 July 2020, the bonus interest rates will be halved - you currently earn 1.20/2.40% p.a. on the first/second S$35,000 on the OCBC 360 Account. Starting from 01 July 2020, this will move to 0.60/1.20% p.a. so it is definitely interesting to see OCBC Bank rolling back on these positive changes that were just implemented last month.

Photo Credit: OCBC Bank

No More Spend Bonus (EAR from 0.30% p.a. to 0.00% p.a.)

Last month, OCBC Bank reduced the EAR on the Spend and Save categories from 0.45% p.a. to 0.30% p.a.. Starting from 01 July 2020, you will no longer earn any bonus interest on the Spend category - this effectively reduces the EAR on the entire OCBC 360 Account by 0.30% p.a.. Currently, you can unlock a 0.30% p.a. bonus interest rate when you charge at least S$500 in total across all your personal OCBC Credit Card(s) each month but starting from 01 July 2020, this bonus will be removed so spending on your OCBC Credit Card(s) will no longer get you anything on the OCBC 360 Account.

Final Thoughts

It certainly is interesting to see OCBC Bank providing disincentive to spend more on their credit cards. As you may already know, OCBC$/Travel$/VOYAGE Miles are now awarded in S$5 blocks (effectively lowering the miles per dollar for lower transaction amounts) and the OCBC VOYAGE Card also saw a reduction in earn rate this morning (making it a less-attractive general spend card). The removal of bonus interest rates on the Spend category will only worsen the proposition to spend more on their cards.

The reduction in EAR on the OCBC 360 Account from 3.35% p.a. to 2.15% p.a. is a significant one that I cannot simply ignore. While I do think that it is prudent to set aside some money for emergencies (and I do think S$70,000 is reasonable for someone my age), I might have to look elsewhere for higher returns. At this moment, the DBS Multiplier Account looks like a fairly strong contender as I spend quite a bit on the DBS Woman's World Card each month and I also have my home mortgage with the bank. However, with that all that said, I am not 100% confident that the other local banks will keep their bonus interest rates as is in this macroeconomic climate.

![[FAKE] World of Hyatt Rumours: Category 9 and 10 Incoming, New Premium Credit Card, and Award Top-offs](https://images.squarespace-cdn.com/content/v1/52ccee75e4b00bc0dba03f46/1591666118538-OES55QII65TO7DNJTN9G/image-asset.jpeg)

The end of an era for one of Singapore’s most accessible airport limo perks: UOB will officially discontinue the complimentary airport transfer benefit for the UOB PRVI Miles American Express Card from 1 April 2026.