My Thoughts on the 2016 Singapore Credit Card Satisfaction Study

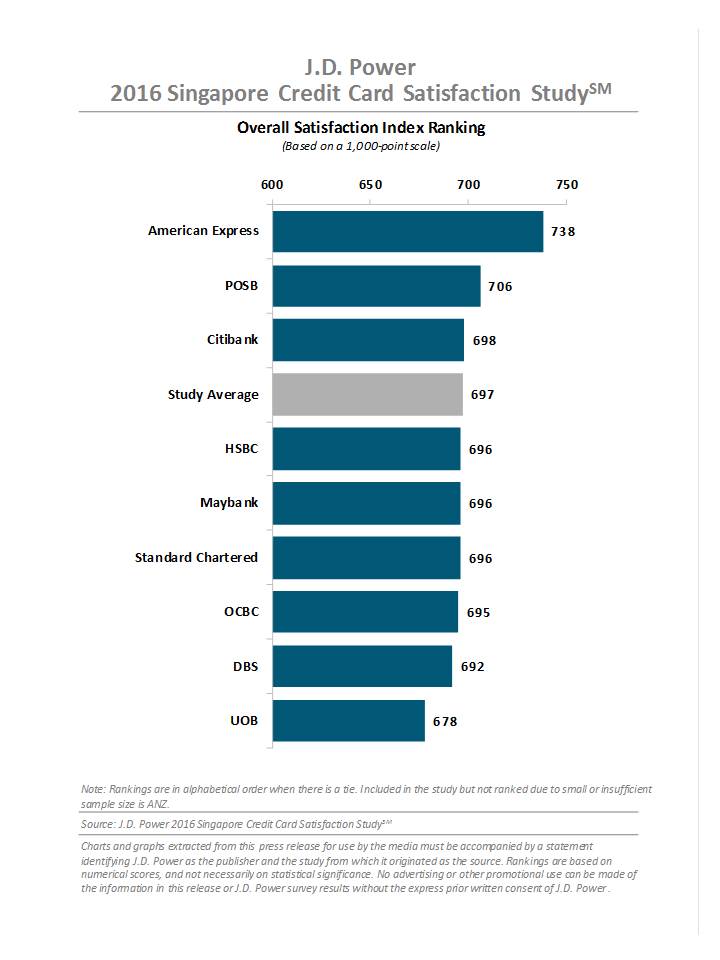

I knew I had to share this piece of news the moment I saw it - not because American Express is ranked number 1 again in the 2016 Singapore Credit Card Satisfaction Study but because it has been quantified and how often do you actually see a press release with a graph?! According to the study, the overall satisfaction index ranking is based on a 1,000-point scale and American Express has come up on top with 738 points, beating the study average by 41 points.

Photo Credit: J.D. Power

What is more interesting to see however is that UOB is ranked the lowest at 678 Points, 19 points shy of the study average. Everyone knows I love the UOB suite of cards - it contributes the most to my miles each month which in turn results in fantastic (and free!) premium cabin flights like this. The study shows that amongst cardholders who pick their cards based on cashback, the overall satisfaction is 712. UOB has terrible cashback cards - the best is probably the UOB Visa Signature Credit Card which gives 5% (upon satisfying a number of conditions) and I guess it is difficult to compete with products like the Standard Chartered SingPost Platinum Visa Credit Card which gives up to 7% cashback - interestingly enough, Standard Chartered is ranked fourth lowest in the latest study as well.

Photo Credit: J.D. Power

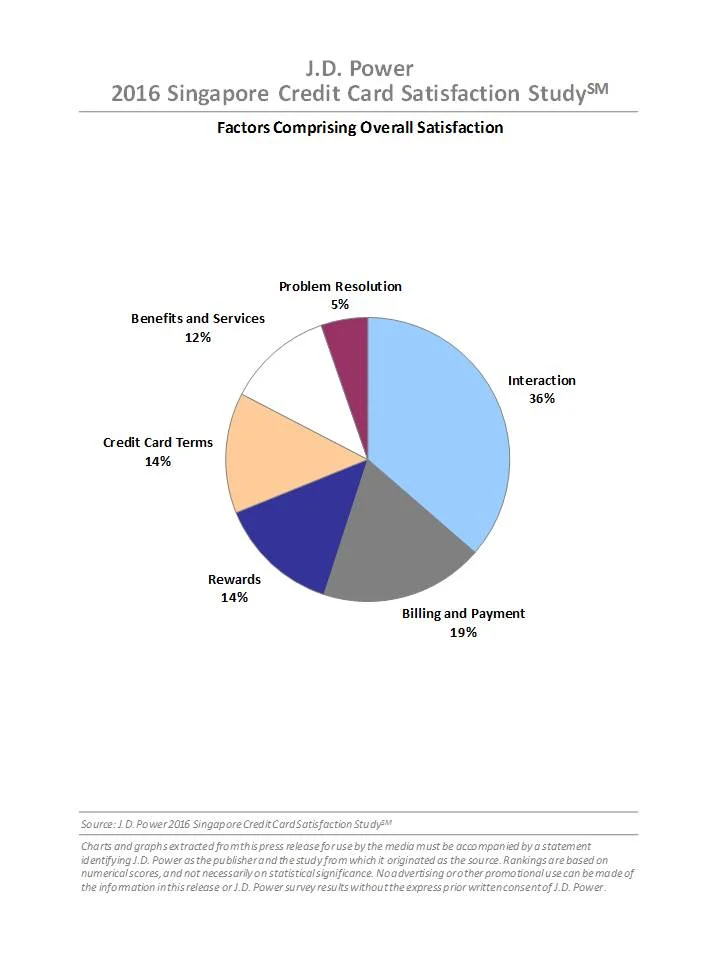

If you look at how the scores are being calculated, Interaction gets a 36% weightage and we all know for a fact that American Express is the market leader on this - if you have spoken to a customer service officer from ANZ or UOB, you will know exactly how much better AmEx is in this component. If you look past the amazing dining benefits that American Express cardholders have with a number of hotels and restaurants, the rewards and benefits on these cards are actually terrible so I can only imagine how badly UOB scored on interaction in order to warrant the last spot on the list.

Photo Credit: American Express

The article does raise an interesting point about how cashback rewards are slowly losing its lustre - so the only question in my head is this: Are consumers in Singapore finally seeing points and miles for what it is worth?

The end of an era for one of Singapore’s most accessible airport limo perks: UOB will officially discontinue the complimentary airport transfer benefit for the UOB PRVI Miles American Express Card from 1 April 2026.