OCBC VOYAGE Card to reduce Dining Earn Rate and increase Base Earn Rate - Should You keep the Card?

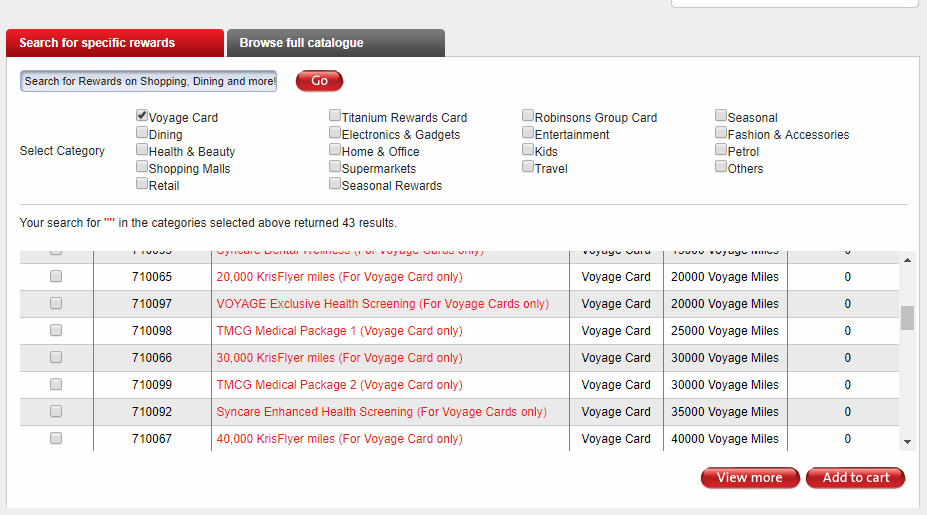

The OCBC VOYAGE Card will be reducing the Voyage Miles (VMs) accrual rate on dining spend from 2.3 VMs per dollar to 1.6 VMs per dollar effective 01 January 2018. Cardmembers will however be able to benefit from a boost in the base earn rate - you will soon be able to earn 1.2 VMs (instead of 1.0 VMs) per dollar on all local retail transactions. Transactions charged in foreign currency will continue to earn 2.3 VMs per dollar (in equivalent SGD).

Photo Credit: OCBC Bank

Dining Credit Cards in Singapore

On the whole, it appears that the earn rate on dining transactions for the credit card market in Singapore has fallen fairly dramatically over the years. We used to be able to get up to 4.0 miles per dollar with no cap when the UOB Preferred Platinum American (PPA) Express and the HSBC Advance Visa Platinum were still around. Strictly speaking, the UOB PPA is still being used (even though you cannot apply for it anymore) but there is now an annual cap on the amount of bonus UNI$ that you can earn from dining transactions.

Photo Credit: OCBC Bank

Reduced Earn Rate on Dining with OCBC VOYAGE Card

The reduced dining earn rate on the OCBC VOYAGE Card will probably turn a number of cardholders away but understandably so. Dropping the earn rate from 2.3 VMs per S$1 to 1.6 VMs is a 30% reduction in miles earned from dining transactions. There are a number of credit cards in the market that still provide a fairly decent earn rate - the HSBC Revolution Credit Card for example, still gives you 2.0 miles per dollar (in equivalent Rewards Points) on all dining transactions without a monthly or annual cap. Alternatively, if you are able to shift your dining expenses to a card that rewards mobile payment like the OCBC Titanium Rewards Card or the UOB Preferred Platinum Visa, you can still earn up to 4.0 miles per dollar when you pay for a meal via contactless mobile payment (e.g. Apple Pay).

VENUE By Sebastian

Improvement to Base Earn Rate on OCBC VOYAGE Card

While the move to reduce dining earn rate on the OCBC VOYAGE Card may not be a favourable one, the improvement to the base earn rate puts it inline with emerging-affluent credit cards like the Citi PremierMiles and the DBS Altitude credit cards. With a base earn rate of 1.2 VMs per S$1, OCBC VOYAGE Cardholders can finally enjoy a more well-rounded credit card. In fact, since 2.3 VMs per S$1 (in equivalent currency) is still being offered, the OCBC VOYAGE Card is still comparatively better than the aforementioned credit cards since it gives 15% more miles on transactions made in foreign currencies.

Plaza Premium Lounge

Changi Airport (Terminal 1)

Lifestyle Benefits to Remain the Same

At the time of writing, it appears that the rest of the benefits will remain the same (which is a good thing!). You will still be able to get up to two complimentary limousine transfers per statement period (one per S$3,000), enjoy unlimited Plaza Premium Lounge access (inclusive of +1 guest privileges) for both main as well as supplementary cardholders, make use of the VOYAGE Exchange concierge and still keep the flexibility of converting your VMs into KrisFlyer Miles or redeem them outright for revenue flights.

Convert VOYAGE Miles to KrisFlyer Miles for Free

Enjoy a waiver on your KrisFlyer Miles redemption admin fee of S$25 when you choose to convert your VOYAGE Miles to KrisFlyer Miles (1 VOYAGE Mile = 1 KrisFlyer Mile).

Should You Keep the OCBC VOYAGE Card?

The annual fee of the OCBC VOYAGE Card is not typically waived (there have been reports about this happening however on HWZ) and paying S$488 for 15,000 VMs is definitely not one of the cheapest ways to purchase miles through credit card annual fees. However, after holding on to the OCBC VOYAGE Card for a year, I noticed a difference In the way things are handled by the VOYAGE Exchange Team versus the Visa Infinite Concierge [see brief comparison here]. Simple requests like dining reservations and booking of transport are fulfilled very quickly by the VOYAGE Exchange Team - I have gotten a 30-minute turnaround time on a dining reservation in Bali previously. They are also great at helping you monitor for things like buying a pair of tickets to see a show (even if the exact dates have not been confirmed). The Visa Infinite Concierge on the other hand is more suitable for complicated requests like traveling from City A to City B on train or finding out places of interest to go to.

Keeping in mind that you can typically purchase 10,000 miles for approximately S$200 (by paying for credit card annual fees), 15,000 miles should cost around S$300 under the same valuation. The extra S$188 that you pay with the annual fee (and renewal fee) of the OCBC VOYAGE Card goes towards providing other privileges like the VOYAGE Exchange Concierge (which you can communicate via email with), the unlimited lounge access as well as other benefits that the bank runs from time to time. In fact, paying for the annual fee on this card is a great way to build the bank of miles if you are new to this whole game - you pay opt to pay a S$10,000 annual fee for this card that will give you 500,000 VMs (which you can then convert into KrisFlyer Miles or redeem them for revenue-ticket on any airline in the world that you can purchase). I can’t say for certain that this is a card that is going to appeal to everyone but if you are looking for a card that will take some hassle out of your lives and you do not mind paying a nominal sum each year to get things done quickly on your behalf, this is definitely one to consider. While I have not personally found an outright flight redemption using VMs that is worthwhile (I am still looking!), having that flexibility to redeem for a revenue ticket is something that I do see value in (especially when there are promotions with Business class tickets) and that’s mainly because you will still earn miles as well as PPS value (if applicable) on these redemption of tickets. I am personally keeping this card - most of my expenses goes towards spending on hotels and flights (both of which are better spent on other credit cards) and most of the restaurants that I go to accept contactless payments. It is important to remember that to be successful at earning miles for free premium cabin travel, you do not always have to capture 100% of your spend (even though that would be a dream) - capturing 70-80% is good enough (at least for a start) for you to start enjoying that First Class and Business Class experience that you so deserve.

The end of an era for one of Singapore’s most accessible airport limo perks: UOB will officially discontinue the complimentary airport transfer benefit for the UOB PRVI Miles American Express Card from 1 April 2026.