Using the Instarem Amaze Card (Free!) to Avoid Foreign Currency Fees and Earn 4 Miles per Dollar - Great for Shopping Online

Instarem has launched the Amaze Card (a consumer debit card) in Singapore and it will allow you to link up to five mastercard credit or debit cards which will help you avoid foreign currency fees of up to 3.5% in Singapore. This is especially great if you are transacting online in a foreign currency and would like to avoid any foreign currency charges that the bank may levy - you will also continue to earn up to 4 miles per dollar on the right credit card so there is really no opportunity cost involved.

Click HERE to sign-up for a free Instarem account and an Amaze Card!

As some of you may know (make sure you follow The Shutterwhale on Telegram for the latest deals), ShopBack was offering massive cashbacks across a range of merchants online over the weekend - I took the opportunity to shop internationally (where I was billed in a foreign currency) as I wanted to take advantage of the cashback offers but more importantly, to test out the Amaze Card to see if it really works as advertised.

Avoid Foreign Currency Charges, Earn The Same Miles

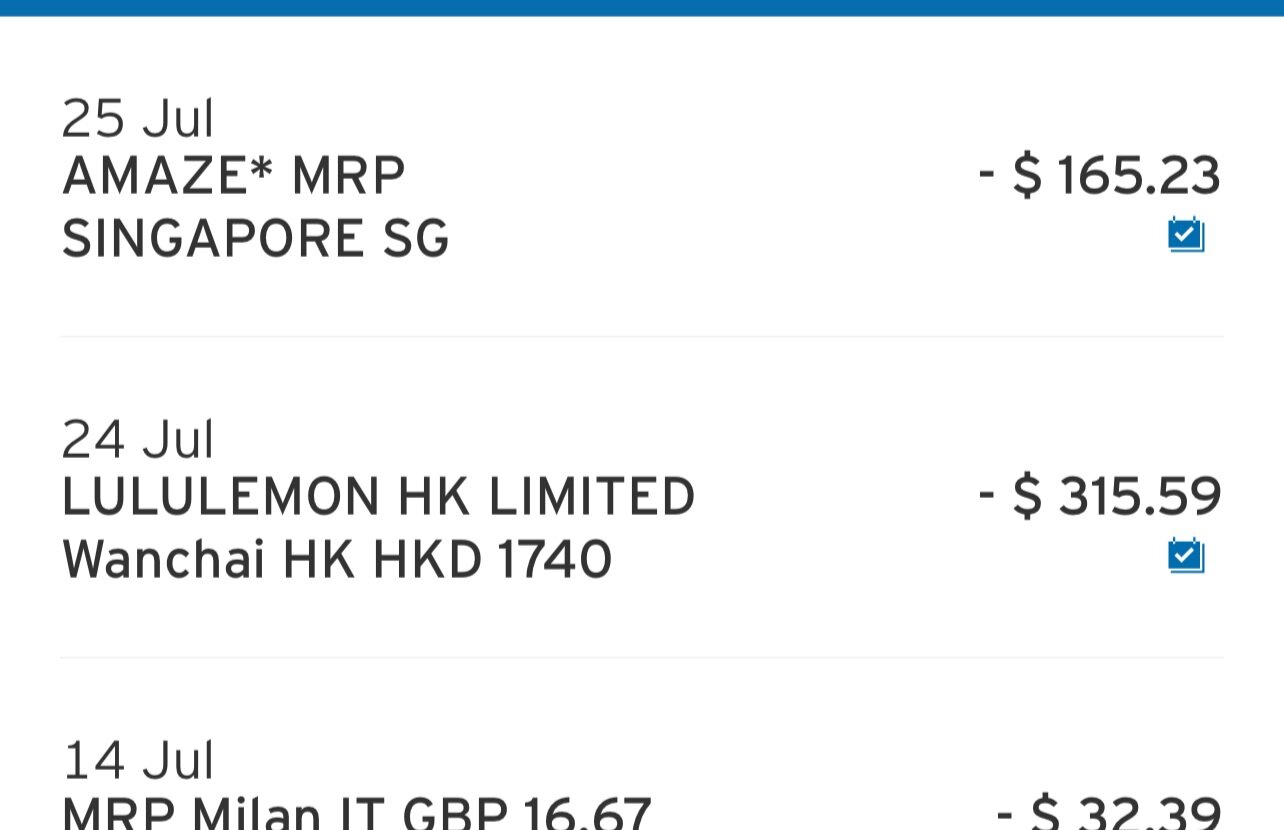

I typically use my Citi Rewards Card on Mr. Porter as it is one of the best credit cards in Singapore for miles - it offers 4 miles per dollar on online shopping - but foreign currency transactions do attract a fee of 3.25% on this card. My order worked out to £88.07 which works out to be approximately S$164.84 based on the exchange rate on the date of transaction.

After accounting for the 3.25% foreign currency fee on the Citi Rewards Card, the posted amount should have been S$170.20 if I were to use the card directly on Mr. Porter and this transaction would have earned me 1,700 Points (equivalent to 680 miles). However, by using the Amaze Card and having my Citi Rewards Card linked to it, I was only billed S$165.23 in total. This allowed me to avoid the 3.25% foreign currency charge that Citibank would have levied upon (since I was billed in SGD as opposed to GBP) and on top of that, I also managed to earn 10X Points (i.e. 4 miles per dollar) on this transaction as the Merchant Category Code remained the same - a total of 1,650 Points (equivalent to 660 miles) were awarded.

The Amaze Card essentially converts a foreign currency charge into SGD and then passes on that converted amount in local currency to the linked mastercard of your choice - you can link up to five credit and debit cards at any time, and you can select the 'actively linked card' from the Instarem app if required. In doing so, you will avoid any foreign currency charge (up to 3.5% for cards on the mastercard network) that the banks will typically levy and you will continue to earn the right number of miles if you were to spend it on linked credit card.

1% Bonus Cashback

According to the terms and conditions of the Amaze Card, you will be eligible for a 1% cashback on the total transaction value processed every quarter if you satisfy the following conditions:

Your minimum total cumulative spending on Your Amaze Card for the quarter, vis-à-vis Eligible Transactions is S$100 or more; and

You must be in possession of a valid Amaze Card on the Cashback Payout Day.

The maximum cashback you can earn each quarter is S$100 and this payment will be made to you on the 25th of the succeeding month after the end of every quarter. Therefore, anything that you earn between July 2021 to September 2021 will be made on 25 October 2021. Going back to my example on Mr. Porter above, I should expect to see a cashback of S$1.65 from this transaction on 25 October 2021.

Amaze Card (Physical)

There is an option to receive a physical Amaze Card and obviously, I have gone ahead to request one since it is free - I will put it to the test once I have received it and will update the article accordingly. In the meantime, may hay while the sun shines as I do not think this arrangement would last for long. Sign-up for an Instarem account and get your free Amaze Card today!

![[FAKE] World of Hyatt Rumours: Category 9 and 10 Incoming, New Premium Credit Card, and Award Top-offs](https://images.squarespace-cdn.com/content/v1/52ccee75e4b00bc0dba03f46/1591666118538-OES55QII65TO7DNJTN9G/image-asset.jpeg)

The end of an era for one of Singapore’s most accessible airport limo perks: UOB will officially discontinue the complimentary airport transfer benefit for the UOB PRVI Miles American Express Card from 1 April 2026.