Earning 4 Miles per Dollar with the OCBC Titanium Rewards Card - Great for Big-Ticket Items and New Home Owners (Annual Instead of Monthly Limit)

Most of the credit cards in the market can be categorised into one of two types - those that award bonus miles based on spend category (specifically merchant category codes), and those that award a fixed number of miles based on local- or foreign-currency spend. If you love traveling in style (and I mean First and Business Class) for free, accruing miles on your credit card is definitely the way to go and there are plenty of credit cards that a mile-chaser in Singapore should consider but as more credit cards impose a monthly cap on the number of bonus points/miles a cardholder can earn, it becomes increasingly important to recognise which credit cards are better suited for big-ticket items - the OCBC Titanium Rewards Card is definitely one you should look at.

Click HERE to apply for the OCBC Titanium Rewards Card and enjoy 2-years annual fee waiver!

While it is not uncommon to see a credit card in Singapore offering up to 4 miles per dollar on specific spend categories, most of these cards cap that accelerated earn rate to the first S$1,000 charged per statement month. For instance, the Citi Rewards Card is a pretty generous credit card that offers cardholders the opportunity to earn 4 miles per dollar on all eligible online transactions as well as a wide range of retail (offline) purchases. However, the number of bonus miles is capped at 4,000 per statement month. Sure, that sounds great and honestly, most people would probably be reasonably satisfied with that limitation, but imagine if you had to purchase a big-ticket item like that beautiful 16-inch MacBook Pro (which starts at S$3,499!) from Apple. In this instance, charging that item to the Citi Rewards Card will only earn you approximately 4,999 miles (since only the first S$1,000 will earn 4mpd and the rest will get a miserable 0.4 mpd). On the other hand, if you were to charge that 16-inch MacBook Pro to the OCBC Titanium Rewards Card, you will be looking at a total of 13,996 miles, which is almost triple of what you would earn with the Citi Rewards Card.

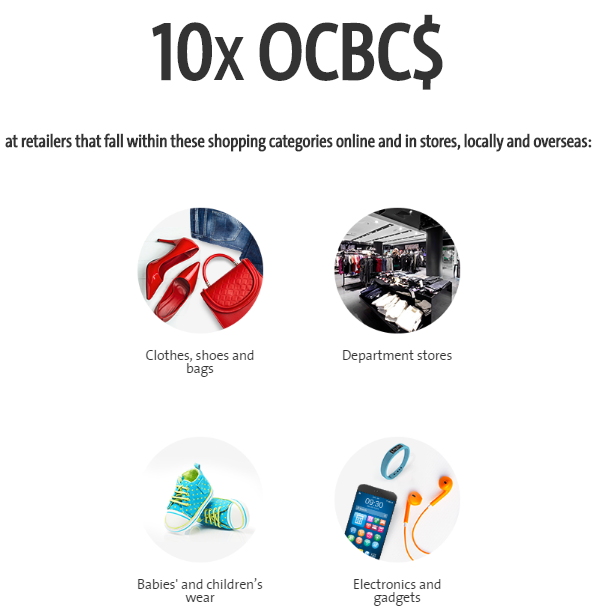

The OCBC Titanium Rewards Card allows you to earn 10X OCBC$ (which translates into 4 miles) for every S$1 spent online or in stores (locally and overseas) so long the merchant category code (MCC) coincides with the list of eligible codes. According to the latest terms and conditions available online, 10X OCBC$ will automatically be awarded for transactions made at merchants that fall within the folloing MCCs:

MCC 5311 Departmental Stores

MCC 5611 Men’s and Boys’ Clothing and Accessories Stores

MCC 5621 Women’s Ready to Wear Stores

MCC 5631 Women’s Accessory and Specialty Stores

MCC 5641 Children’s and Infants’ Wear Stores

MCC 5651 Family Clothing Stores

MCC 5661 Shoe Stores

MCC 5691 Men’s and Women’s Clothing Stores

MCC 5045 Computers, Peripherals, and Software

MCC 5732 Electronics Stores

MCC 5699 Miscellaneous Apparel and Accessory Shops

Additionally, transactions made at merchants such as IKEA, Courts and Alibaba (amongst others) will also qualify for 10X OCBC$ - this makes having the OCBC Titanium Rewards Card an attractive option for new homeowners since you will be able to charge your furniture and white goods to this card and earn enough miles for a free vacation. There are two versions of the OCBC Titanium Rewards Card - blue and pink - but they are exactly the same. With that being said, each colour is recognised as a different card as far as bonus miles (in the form of OCBC$) are concerned. What this means to say is that you can essentially apply for both the blue as well as the pink version to earn up to 96,000 miles per year from just S$24,000 spend (4mpd!).

In fact, if you have just gotten a new place with your partner and you are both expecting to spend quite a bit of money on white goods and electronics, you will both be able to apply for both versions (read: blue and pink) of the OCBC Titanium Rewards Card. By doing so, you will be able to earn up to 192,000 miles by spending S$48,000 across all eligible merchants - this is enough for a return-trip to Japan in Business Class on Singapore Airlines for two adults!

![[FAKE] World of Hyatt Rumours: Category 9 and 10 Incoming, New Premium Credit Card, and Award Top-offs](https://images.squarespace-cdn.com/content/v1/52ccee75e4b00bc0dba03f46/1591666118538-OES55QII65TO7DNJTN9G/image-asset.jpeg)

The end of an era for one of Singapore’s most accessible airport limo perks: UOB will officially discontinue the complimentary airport transfer benefit for the UOB PRVI Miles American Express Card from 1 April 2026.