HSBC Revolution Credit Card Will Award 4 Miles per Dollar (or 2.5% Cashback) on Online and Contactless Payments from 01 August 2020

The HSBC Revolution Credit Card will earn its place at being one of the best credit cards in Singapore for miles from 01 August 2020. The new terms and conditions will go live next month, allowing cardholders to earn 4 miles per dollar (capped at S$1,000) or 2.5% cashback for all eligible online and contactless (including Apple Pay) payments. This is a huge step-up from the current 2 miles per dollar earn rate even though categories such as local dining and local entertainment will take a hit (but there might be a way around it). Eligible new customers will also be able to choose between a Samsonite Prestige 69cm Spinner Exp with built-in scale (worth SGD670) or SGD 150 cashback when they spend at least SGD 800 during the qualifying period.

Click HERE to sign-up for the HSBC Revolution Credit Card to start earning 4 miles per dollar!

No More Annual Fees

The HSBC Revolution Credit Card will no longer have an annual fee from 01 August 2020 (until decided by HSBC) - this means that you do not have to worry about meeting a certain spend threshold each year and do not have to monitor your statement closely before asking for a fee waiver. This is excellent news since you can use this card as much (or as little) as you want, depending on what your need situation is.

Earn 4 Miles per Dollar or 2.5% Cashback

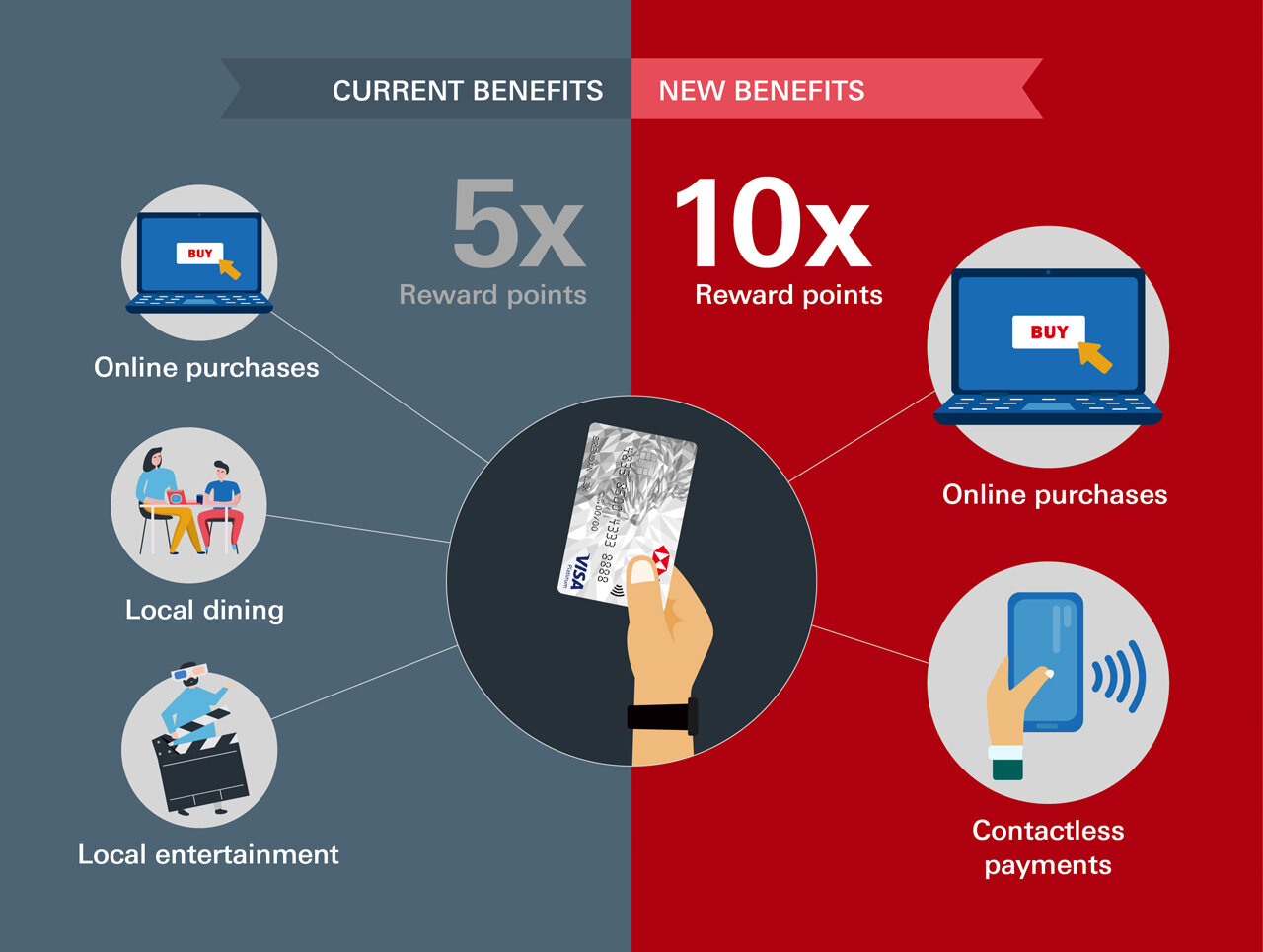

Most importantly, the HSBC Revolution Credit Card will begin to earn 10X Rewards points (capped at 10,000 Rewards points or S$1,000 in eligible spend) from 01 August 2020 for all eligible online and contactless payments that fall within any one of the listed Merchant Category Codes (MCC). Depending on whether you are interested in miles or cashback, this can translate into an impressive 4 miles per dollar earn rate or 2.5% cashback (which is still very decent).

According to the terms and conditions published by HSBC, eligible transactions refer to selected online and contactless payments that fall within the aforementioned Merchant Category Codes. Much like the UOB Preferred Platinum Visa Card, the HSBC Revolution Credit Card will also offer 4 miles per dollar for contactless transactions but the main difference is this - certain MCCs are excluded for the former card while the latter card only earns 10X Rewards points on selected MCCs.

With all that being said, this is still a great card to earn 4 miles per dollar on and I highly recommend you get this card alongside other 4 miles per dollar credit cards that will allow you to build your mileage bank quickly. For contactless transactions, Apple Pay is also allowed but of course you can also choose to tap your physical credit card at contactless payment terminals.

What Has Changed?

Previously the HSBC Revolution Credit Card awarded only 5X Rewards points (essentially 2 miles per dollar) for eligible transactions made on local dining and local entertainment. With the upcoming change on 01 August 2020, it will no longer award bonus points on these transactions and this means to say that you will only earn 1X Rewards point (0.4 miles per dollar) and therefore you should not.

However, if the restaurant that you are visiting on and after 01 August 2020 falls into one of the aforementioned MCCs, you can still opt to pay for it using a contactless mode of payment to earn 10X Rewards points. As mentioned earlier, there is also now a S$1,000 cap on the amount that you can earn 10X on so do keep that in mind if you are planning to make a large transaction.

Free Samsonite Luggage/Cashback and SGD 30 Grab Vouchers

Eligible new customers can select between a Samsonite Luggage (Prestige 69cm Spinner Exp with built-in scale) worth SGD 670 or a SGD 150 cashback if they spend at least S$800 during the qualifying period (from Card Account Opening Date to the end of the following calendar month). In order to qualify as an eligible new customer, you must not currently hold any existing HSBC Credit Cards and you must not have cancelled any HSBC Credit Cards within the last 12 months. If you do not meet both conditions and apply for the HSBC Revolution Credit Card, you will be considered as an existing customer and you will only receive SGD 30 cashback upon satisfying the same S$800 minimum spend condition.

Additionally, customers who apply for the HSBC Revolution Credit Card online using MyInfo via SingPass will receive SGD 30 worth of Grab rides (this is on top of the welcome offer above) but you will have to submit the application by 31 August 2020 and receive approval by 15 September 2020.

As we head into 2026, the miles game has shifted. With tighter caps on key cards like the UOB Preferred Platinum Visa and UOB Lady's Solitaire, optimising spend is more crucial than ever. In this article, I share the six credit cards I will be actively using in the upcoming year.