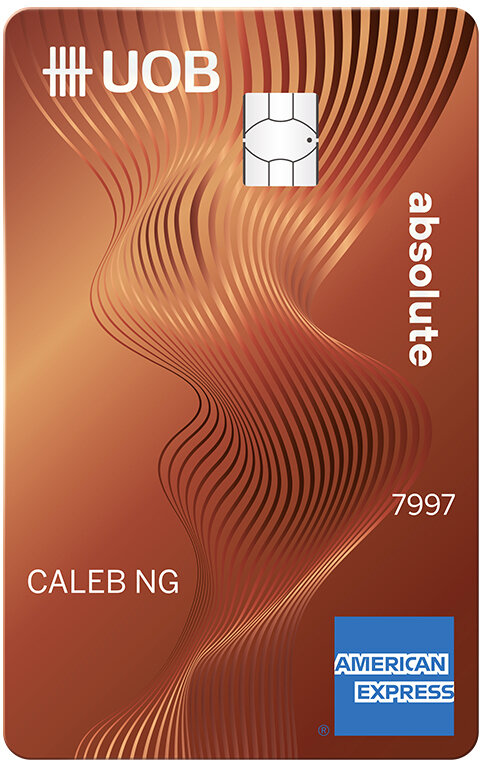

UOB and American Express Launch New UOB Absolute Cashback Card with 1.7% Flat Cashback on Almost Everything - Including Commonly Excluded Categories (e.g. Insurance, Bills and Wallet Top-ups)

UOB and American Express have just officially unveiled a brand new credit card in Singapore - the UOB Absolute Cashback Card - that will offer a flat 1.7% cashback. With the introduction of this brand new credit card, it will be ranked the best cashback credit card in Singapore with no cap on cash rebates, and no minimum spend required each month.

Click HERE to find out more about the UOB Absolute Cashback Card!

The UOB Absolute Cashback Card is the first credit card by a local bank that offers customers cashback on all eligible credit card spend (so long the merchant or payment gateway accepts American Express cards) which includes things like insurance, school fees, hospital bills, rent, and wallet top-ups which are typically excluded. The 1.7% cashback is one of the highest in Singapore and not having to worry about a certain spend requirement or cap on the cash rebate each month can be a liberating experience.

According to the terms and conditions published by UOB, the only transactions that will be excluded are as follows:

(a) all NETS and NETS-related transactions;

(b) Installment Payment Plans, SmartPay transactions (unless otherwise stated);

(c) cash advances;

(d) any fees and/or charges (including without limitation, late payment charges, interest charges, annual or monthly fees or charges, service fees or processing fees) imposed by UOB;

(e) personal loans, balance and/or fund transfers;

(f) any transaction that is subsequently cancelled, voided, refunded or reversed; and

(g) amounts which have been rolled over from any preceding month’s statemen

Being able to get 1.7% cashback on things like insurance, wallet top-ups (e.g. GrabPay) and hospital bills can be quite significant so if you have been looking for a cashback card with no spend exclusions, this is truly one to apply for. To stay up-to-date with the latest promotions, deals, and reviews, follow The Shutterwhale on Telegram or check out The Shutterwhale Cards for the newest and biggest credit card sign-up offers!

![[FAKE] World of Hyatt Rumours: Category 9 and 10 Incoming, New Premium Credit Card, and Award Top-offs](https://images.squarespace-cdn.com/content/v1/52ccee75e4b00bc0dba03f46/1591666118538-OES55QII65TO7DNJTN9G/image-asset.jpeg)

The end of an era for one of Singapore’s most accessible airport limo perks: UOB will officially discontinue the complimentary airport transfer benefit for the UOB PRVI Miles American Express Card from 1 April 2026.